The KFin Technologies IPO allocation basis is currently accessible.

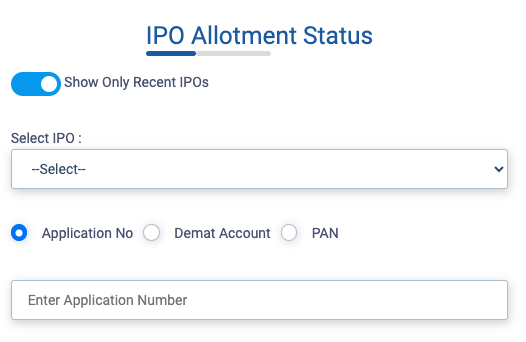

Use the procedures listed below to find out the status of KFin Technologies’ IPO allotment:

- Click the “Check Allocation Status” button below.

- Choose the name of the company.

- Enter your DP Client ID (Anyone), Application Number, or PAN Number.

- Press the Search button.

You will be credited with comparable shares in your Demat account upon obtaining the allotment.

Click to Check KFinTech IPO Allotment Status

The KFin Technologies IPO is a Rs 1,500.00 crore book-built offering. The entire issue consists of a 4.10 crore share selling offer.

The bidding for KFin Technologies’ initial public offering (IPO) began on December 19, 2022, and finished on December 21, 2022. On Monday, December 26, 2022, the KFin Technologies IPO allocation was finalized. On December 29, 2022, the shares were listed on the BSE and NSE.

The price range for KFin Technologies’ IPO is ₹347 to ₹366 per share. An application must have a minimum lot size of 40. Retail investors are required to invest a minimum of ₹14,640. sNII requires a minimum lot size investment of 14 lots (560 shares), or ₹2,04,960, while bNII requires 69 lots (2,760 shares), or ₹10,10,160.

The book running lead managers of the KFin Technologies IPO are ICICI Securities Limited, Kotak Mahindra Capital Company Limited, J.P. Morgan India Private Limited, Iifl Securities Ltd, and Jefferies India Private Limited. The issue’s registrar is Bigshare Services Pvt Ltd.

For more information, see the KFin Technologies IPO RHP.

KFin Technologies Limited Stock Quote & Charts

-0.40 (-0.03%)

- Open: ₹1,231.05

- High – Low: ₹1,260.40 – ₹1,220.15

- Previous Close: ₹1,252.70

- Total Traded Value: 5,36,653.00

- 52 Weeks High: ₹1,313.70 (Dec 05, 2024)

- 52 Weeks Low: ₹456.25 (Dec 21, 2023)

- Updated On: Dec 16, 2024 4:00 PM

Also Read:

KFin Technologies IPO Details

| IPO Date | December 19, 2022 to December 21, 2022 |

| Listing Date | December 29, 2022 |

| Face Value | ₹10 per share |

| Price Band | ₹347 to ₹366 per share |

| Lot Size | 40 Shares |

| Total Issue Size | 4,09,83,607 shares (aggregating up to ₹1,500.00 Cr) |

| Offer for Sale | 4,09,83,607 shares of ₹10 (aggregating up to ₹1,500.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share Holding Pre Issue | 16,75,68,883 shares |

| Share Holding Post Issue | 16,75,68,883 shares |

KFin Technologies IPO Reservation

42,217,838 shares are offered in the KFin Technologies IPO. Anchor investors received 12,968,300 (30.72%), 6,484,149 (15.36%), 4,322,766 (10.24%), and RII 18,442,623 (43.68%). 3,859 (sNII) and 7,719 (bNII) will receive at least 560 shares, while 108,069 RIIs will receive at least 40 shares. (If an oversubscription occurs)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | 18,442,623 (43.68%) | NA |

| QIB Shares Offered | 12,968,300 (30.72%) | NA |

| NII (HNI) Shares Offered | 6,484,149 (15.36%) | |

| bNII > ₹10L | 4,322,766 (10.24%) | 7,719 |

| sNII < ₹10L | 2,161,383 (5.12%) | 3,859 |

| Retail Shares Offered | 4,322,766 (10.24%) | 108,069 |

| Total Shares Offered | 42,217,838 (100%) |

Potential Consequences of Spending Years preparing for UPSC

KFin Technologies IPO Anchor Investors Details

| Bid Date | December 16, 2022 |

| Shares Offered | 1,84,42,623 |

| Anchor Portion Size (In Cr.) | 675.00 |

| Anchor lock-in period end date for 50% shares (30 Days) | January 25, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | March 26, 2023 |

KFin Technologies IPO Timeline (Tentative Schedule)

KFin Technologies IPO IPO opens on December 19, 2022, and closes on December 21, 2022.

| IPO Open Date | Monday, December 19, 2022 |

| IPO Close Date | Wednesday, December 21, 2022 |

| Basis of Allotment | Monday, December 26, 2022 |

| Initiation of Refunds | Tuesday, December 27, 2022 |

| Credit of Shares to Demat | Wednesday, December 28, 2022 |

| Listing Date | Thursday, December 29, 2022 |

| Cut-off time for UPI mandate confirmation | 5 PM on December 21, 2022 |

KFin Technologies IPO Lot Size

Investors can bid for a minimum of 40 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 40 | ₹14,640 |

| Retail (Max) | 13 | 520 | ₹1,90,320 |

| S-HNI (Min) | 14 | 560 | ₹2,04,960 |

| S-HNI (Max) | 68 | 2,720 | ₹9,95,520 |

| B-HNI (Min) | 69 | 2,760 | ₹10,10,160 |

| Lot Size Calculator | |||

The True Meaning of 1 Billion: Why Health Is the Ultimate Wealth

About KFin Technologies Limited

According to a number of AMC clients it serves, as of September 30, 2022, the company is the biggest supplier of investor solutions for Indian mutual funds. As of September 30, 2022, the organization additionally serves 301 funds belonging to 192 asset managers in India.

How to Identify Fake Cooking Oil?

As of September 30, 2022, KFin Technologies Limited is the sole provider of investor and issuer solutions in India, providing services to corporate issuers, wealth managers, pension funds, mutual funds, and alternative investment funds (“AIFs”). KFin Technologies Limited is one of the two central record-keeping agencies (“CRAs”) that are currently in operation for the National Pension System (“NPS”) in India.

As of September 30, 2022, KFin Technologies Limited is the biggest issuer solutions supplier in India, according to the number of clients it serves.

Air Purifier for Home – Bedroom, Living Room at Affordable Prices

The following is how the business has categorized its goods and services:

1. Investor solutions, including Brokerage Calculations, Account Setup, Transaction Origination, Redemption, and Compliance/Regulatory Reporting Recordkeeping.

Wealth management, pension services, foreign mutual funds, alternatives, and domestic mutual funds.

2. Issuer solutions (e.g., e-AGM, e-Vault, Compliance/Regulatory Reporting Recordkeeping MIS, Corporate Action Processing, IPO, FPO, and Folio Creation and Maintenance).

3. International business domestic mutual services (finance, accounting, transfer agency, legal services, and mortgage services).

For the fiscal year 2022 and the six months ending September 30, 2022, the company’s operating revenue was Rs 6,395.07 million and Rs 3,487.68 million, respectively.

Also Read:

Shubhangi Gupta is a distinguished content writer and the visionary founder of The Unpleasant – Acha Nahi Sabse Sacha. With a Master’s degree in Commerce from University of Lucknow, Shubhangi has seamlessly blended her academic background with her passion for reading and writing, embarking on a successful career as a content writer since 2019.

One thought on “KFinTech IPO Allotment Status Online”