The ₹169.65 Cr Shree Tirupati Balajee IPO share allotment is scheduled to be finalized/declared on September 10, 2024, with the shares anticipated to list on September 12, 2024. On the official website of the registrar, anyone who applied for the Shree Tirupati Balajee public issue can check their allotment status online. Visit the Shree Tirupati Balajee IPO Allotment URL to view the step-by-step instructions for checking.

How to check Shree Tirupati Balajee Agro IPO Allotment Status?

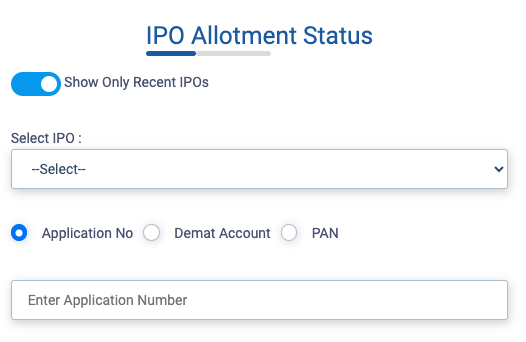

To find out if you received an IPO allotment for the AShree Tirupati Balajee public issue, follow the steps below;

- Go to the IPO allotment page for Link Intime (registrar) (Link)

- From the drop-down menu, choose Shree Tirupati Balajee as the issuing company name.

- You can now select to submit your DP customer ID/Demat account number,

- IPO Application number, or PAN number.

- Enter information using the chosen option.

- When you tap the ‘Search’ option, the screen will display the allocation status.

- The screen will show the shares that you have sought for and been granted.

- Note: The registrar bears responsibility for the share allocation, crediting, and refunding procedures. As a result, you can contact the registrar with any questions you may have about share allocation and refunds.

Your bank and broker will also notify you through email and SMS with the progress of your allotment. A bidder can access their Demat account with your broker and verify the progress of their allotment by logging in.

Status of Shree Tirupati Balajee’s IPO Allotment:The link will be provided as soon as the Shree Tirupati Balajee IPO Allotment is released. It is anticipated that the allocation will be made public by September 10, 2024.

What is the basis of Shree Tirupati Balajee IPO allotment?

An IPO bidder should review the IPO basis of allotment (BOA) if they wish to understand how shares are distributed to various investor types.

The Basis of Allotment (BOA), a crucial document created by the registrar, contains comprehensive information about the number of bids or applications that anchor investors, QIBs, NIIs, and retail investors (RII) have received for the public offering, as well as the ratio of shares allocated. As a result, the document illustrates the demand for the IPO by giving information on the quantity of applications received, the shares reserved for each category, and the percentage of shares allocated to each applicant category.

The BOA’s allocation ratio outlines how many applicants—out of a certain number—will receive one lot of shares. For example, a ratio of 1:10 indicates that one IPO lot will be awarded to each of the ten applicants for the IPO.

Shubhangi Gupta is a distinguished content writer and the visionary founder of The Unpleasant – Acha Nahi Sabse Sacha. With a Master’s degree in Commerce from University of Lucknow, Shubhangi has seamlessly blended her academic background with her passion for reading and writing, embarking on a successful career as a content writer since 2019.