NTPC Green Energy IPO: There won’t be any offer-for-sale (OFS) elements to this first share offering, which will be a completely new issue. The business stated that it will utilise the money from the IPO to pay down debt and for general business needs.

NTPC Green Energy Ltd., the green energy division of the state-run NTPC, has submitted its draft red herring prospectus (DRHP) for an initial public offering (IPO) in an effort to earn Rs 10,000 crore. The first offering of shares for sale will be a completely new issue without any offer-for-sale (OFS) elements. The business stated that it will utilise the money from the IPO to pay down debt and for general business needs.

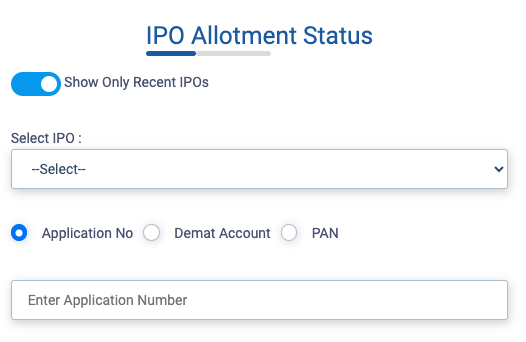

When the issue is up for bid, a retail investor who has shares in NTPC Ltd. will stand to gain more. Likewise, it will confer greater advantages to the staff of NTPC Green Energy.

In short, the maximum amount that ordinary investors can invest in an IPO is Rs 2 lakhs. The maximum amount is increased to Rs 4 lakh crore if you bid under the shareholder category and you own an NTPC share.

Workers of NTPC Green Energy who own stock in its parent company may benefit more. They may submit offers totalling Rs 6 lakh crore under the shareholder, eligible employee, and retail categories.

Nevertheless, it should be mentioned that prior to NTPC’s arm filing its draft documents with market regulator Sebi, a person needs to be a shareholder in the company’s books.

According to the draft documents, the offering would be overseen by a group of book-running lead managers that includes IDBI Capital Markets & Securities, HDFC Bank, IIFL Securities, and Nuvama Wealth Management.

The NTPC Green IPO may draw a lot of interest from investors, according to Kranthi Bathini, director of equity strategy at WealthMills Securities. She noted that since green energy is still a top priority in the near future, NTPC’s action also indicates its intention to diversify earnings by looking into other energy sources.

With over 235 firms raising over Rs 71,000 crore so far this year, the IPO scene in India has become more vibrant.

In the meantime, NTPC shares increased by 4.35 percent today to close at Rs 431.85, a record high. At Rs 424, the stock ultimately finished 2.45% higher.

Shubhangi Gupta is a distinguished content writer and the visionary founder of The Unpleasant – Acha Nahi Sabse Sacha. With a Master’s degree in Commerce from University of Lucknow, Shubhangi has seamlessly blended her academic background with her passion for reading and writing, embarking on a successful career as a content writer since 2019.