Now accessible is NPS Vatsalya: An NPS Vatsalya account can be opened online or offline. Through the internet portal eNPS, the National Pension System (NPS) Vatsalya account can be opened quickly.

NPS Vatsalya Pension Scheme – NPS Vatsalya Calculator

NPS Vatsalya officially launched on September 18 (Wednesday), and it is currently accepting subscriptions. In support of the initiative, Axis Bank and ICICI Bank will open NPS Vatsalya accounts at all of its branches.

Similar to the National Pension Scheme, NPS Vatsalya is a contributory plan with tiers of savings options, exposure to equity markets, and is intended for younger members of society. It will be their parents or guardians who make the investment. The Pension Fund Regulatory and Development Authority (PFRDA) will supervise the plan.

How to Open an NPS Vatsalya Account?

An NPS Vatsalya account can be opened online or offline. Through the internet portal eNPS, the National Pension System (NPS) Vatsalya account can be opened quickly.

This online solution improves overall efficiency and user experience by streamlining the initial enrolment process for an NPS Vatsalya account and making it easier for people to make subsequent contributions.

You may choose to register with Protean, KFintech, or Cams NPS, three Central Recordkeeping Agencies (CRAs).

How to Login to your Vatsalya Account?

- Go to the NPS Vatsalya dedicated portal or the official website of the National Pension System (NPS).

- Find the ‘Register’ button or link in the relevant area or on the homepage. Select the option to create a new NPS account by clicking on it.

- Complete the necessary fields and, if relevant, include the guardian’s information.

- The NPS for Minor account can be formed through registered Points of Presence (POPs) under PFRDA in addition to online registration.

- You can do this in person or online at India Post, major banks, and pension institutions.

- You may find a detailed inventory of these POPs at www.pfrda.org.in, the PFRDA website.

Documents Required to Open Vatsalya Account

The following necessary paperwork must be submitted in order to open an NPS Vatsalya account:

Birth Certificate: A birth certificate, school leaving certificate, matriculation certificate, PAN card, or minor’s passport are acceptable documents for this purpose.

KYC for Guardian: The guardian must provide proof of identification and address. Aadhar card, driver’s license, passport, voter ID card, NREGA job card, and documentation from the National Population Register are all acceptable forms of identification.

Bank Account: If the guardian is an NRI, they must have a non-resident external (NRE) or non-resident ordinary (NRO) bank account (single or joint) specifically for the minor.

How to Open NPS Vatsalya Account Offline?

Axis Bank: To get started, parents or guardians must bring the needed paperwork, including the child’s birth certificate, PAN card, and card, to the nearest Axis Bank branch. Families have the freedom to choose from a range of investment options offered by the bank under the program, depending on their financial goals.

ICICI Bank: To open an account, clients should go to their nearby ICICI Bank branch. Its business centres all offer the ability to open NPS Vatsalya accounts.

Author’s View

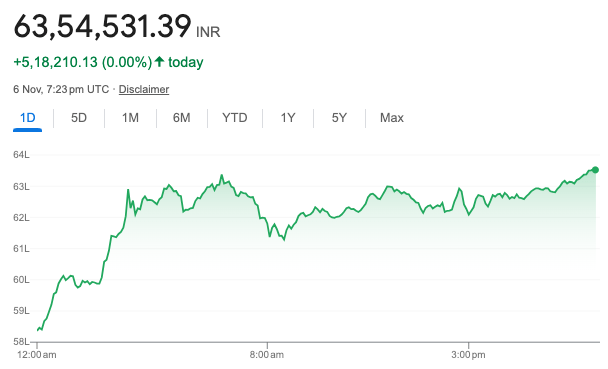

NPS Vatsalya Pension Scheme is very useful if you open a Vatsalya account in the early age of your child. It is as good as early you open it. It can get your child more than 10 crore on retirement if you invest Rs 10,000 every year till he/ she becomes 18 years old. The above article will provide complete details on how to open a NPS vatsalya pension account both online as well as offline.

Shubhangi Gupta is a distinguished content writer and the visionary founder of The Unpleasant – Acha Nahi Sabse Sacha. With a Master’s degree in Commerce from University of Lucknow, Shubhangi has seamlessly blended her academic background with her passion for reading and writing, embarking on a successful career as a content writer since 2019.

One thought on “NPS Vatsalya Pension Scheme – How to Open Account?”