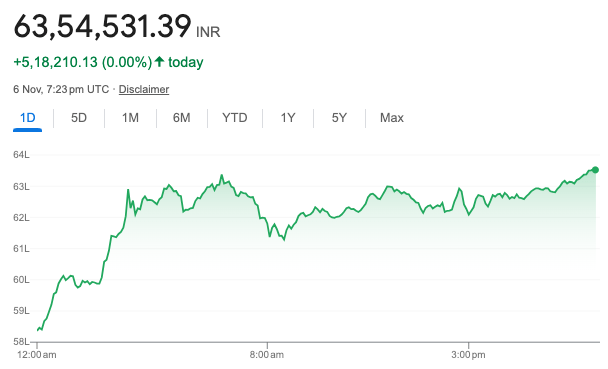

Bitcoin Live Price Data

Bitcoin’s current price is $75,540.6, and over the past 24 hours, $515.77 million has been traded. Bitcoin’s value has risen by +5.06% during the last week, while its price has moved by +7.73% in the last day. The market capitalisation of Bitcoin is at 1.48 trillion USD, representing a –% rise today, with a circulating supply of 19,778,606 BTC. Right now, Bitcoin has the largest market capitalisation.

Click Here to check Live Bitcoin Price

How can I buy Bitcoin?

Purchasing Bitcoin on KuCoin is quick and easy. Make an account, confirm your identity, make a deposit, and begin trading. It’s that easy!

What is Bitcoin?

The first cryptocurrency in history created to function decentralised via a blockchain is called Bitcoin. In contrast to conventional currencies, it can be used to make digital payments and hold value without the need for a centralised authority like a bank or other financial organisation. In the market, Bitcoin is represented by the symbol BTC.

Although digital payments have been around for a while, Bitcoin’s decentralised qualities make it unique. Bitcoin transactions occur peer-to-peer on the blockchain without the need for an intermediary authority, eliminating the need for reliance on the conventional financial infrastructure.

Purchasing Bitcoin entitles you to a portion of this virtual currency. Its value is subject to quick fluctuations and presents both opportunities and threats. Bitcoin is immune against counterfeiting since it is encrypted and may be stored in a digital wallet. Bitcoin is viewed by many as a means of diversifying their investment portfolios and as a hedge against established financial systems.

The restricted quantity of Bitcoin distinguishes it from a number of other assets. Bitcoin is as scarce as precious metals like gold because there will only ever be 21 million of them produced. Mining is the process by which people or organisations use powerful computers to solve intricate mathematical puzzles and verify network transactions, producing Bitcoins.

How does Bitcoin Work?

Blockchain is the technology that powers Bitcoin (BTC). A public ledger called Blockchain keeps track of every Bitcoin transaction. Your transaction is added to a block when you send Bitcoin. By resolving challenging mathematical problems, miners—specialized computers—verify these transactions. The transaction is finished when the block is added to the blockchain after verification.

Using a digital wallet with a private key, you manage your Bitcoin. You can access your Bitcoin using this key, which functions similarly to a password. Your Bitcoin cannot be moved or spent without it. Since the system is decentralised, no one person or organisation has complete authority over it. Because of this, Bitcoin is safe and impervious to deception.

Users can conduct transactions directly with one another without the assistance of a bank or other middleman. Depending on network traffic, this operation may take a few minutes to an hour. Bitcoin is always changing, opening up new ways for money to function in the digital era.

Who created Bitcoin?

Under the alias Satoshi Nakamoto, an unidentified individual or group established Bitcoin (BTC). When the Genesis Block, the first Bitcoin block, was mined in January 2009, it was officially launched. Bitcoin was intended to be a decentralised digital currency that was unaffected by or controlled by the government.

Blocks of Inception and Genesis

Bitcoin’s inventor, Nakamoto, successfully mined the genesis block, the first block of the cryptocurrency, on January 3, 2009. With a starting value of zero, it signalled the formal launch of Bitcoin. The value of Bitcoin steadily rose over time, which boosted mining activity and raised demand for the virtual currency.

Bitcoin Pizza Day: Using Bitcoin for Business Transactions

The first commercial Bitcoin transaction was carried out by a user in 2010, marking a significant milestone. Computer programmer Laszlo Hanyecz used Bitcoin to buy two pizzas, with a transaction value of an incredible 10,000 BTC. Interestingly, this Bitcoin pizza transaction happened at a time when the price of Bitcoin was significantly lower than it is now.

The Bitcoin Blockchain’s Development

The Bitcoin blockchain has had a number of significant modifications since its launch. The Taproot Update, which launched in 2021, is among the biggest updates. By using the “MAST” approach, which obfuscates private transaction data, this update improves the security of Bitcoin transactions when Segregated Witness (SegWit) was introduced in 2017. These updates support the ongoing growth of the Bitcoin ecosystem.

The Lightning Network for Bitcoin

One significant development in Bitcoin’s roadmap is the Bitcoin Lightning Network. Built on top of Bitcoin, it is a Layer-2 payment mechanism intended to increase transaction throughput and scalability. The scalability issues with the foundation layer of the Bitcoin blockchain are resolved by utilising the Lightning Network, which speeds up and lowers the cost of Bitcoin transactions.

Upgrade for Bitcoin Taproot

Taproot is regarded as the biggest update to Bitcoin in a number of years. Transaction processing is streamlined, increasing speed and efficiency. On November 14, 2021, Taproot went online at block 709,632. It makes multi-signature transactions more cheap by lowering their cost and data requirements. Additionally, it enhances transaction privacy by making some complicated transactions—such as those on the Lightning Network—appear to be identical to ordinary transactions.

NFTs and Ordinals for Bitcoin

Bitcoin ordinals, sometimes referred to as Bitcoin NFTs, are a type of NFT that is exclusive to the Bitcoin network. The cryptocurrency industry has since taken notice of Bitcoin ordinals and the BRC-20 token standard, which were first introduced in January 2023. Individual satoshis, the smallest units of Bitcoin, can have information attached to them to construct ordinals. The equivalent of a satoshi is 0.00000001 Bitcoin. Through engraving, the equivalent of a “serial code” can be used to uniquely identify each satoshi. A variety of data formats, including text, pictures, audio, and videos, may be included in this inscription.

Acceptance of Bitcoin ETFs for Spots

A significant turning point for the cryptocurrency sector was reached in January 2024 when spot Bitcoin ETFs were approved in the United States. Institutional and ordinary investors can participate more easily with a spot Bitcoin ETF since it gives them exposure to Bitcoin without requiring them to possess the actual asset. Because of its greater accessibility, Bitcoin may see a large influx of capital, which might drive its price to all-time highs.

Also Read:

- Equatorial Guinea’s Director General caught in Sex Scandal

- Daylight Savings 2025 – When did it End?

- Chase Oliver, RKF Jr Gain Traction among Voter tired of Trump, Harris choices

- Robert Kennedy Jr.’s fringe views on vaccines and fluoride are gain support from Donald Trump

- CAT Admit Card 2024 Out – Correct Errors, Test Centre, FAQs

Shubhangi Gupta is a distinguished content writer and the visionary founder of The Unpleasant – Acha Nahi Sabse Sacha. With a Master’s degree in Commerce from University of Lucknow, Shubhangi has seamlessly blended her academic background with her passion for reading and writing, embarking on a successful career as a content writer since 2019.